Americans face financial problems more often nowadays. However, the quality of your living shouldn’t suffer a lot because of it. If you found yourself in need to draw upon bills urgently or pay extra funds for medical expenses, consider a Title loan as the way out of your troubles. Remember, that such situations can cause excessive discomfort. It will cause the lack of sleep, your work and relationships can also be affected. Don’t get used to it. In the end, it will lead to expansion of the stress level. It is better to consider applying for a title loan. Find out what you need to obtain a title loan and you will be able to enjoy the advantages connected with it. However, if your credit history is far from perfect the process of getting it can become a bit complicated. Anyway, there are alternatives even for those with bad credit.

What is a title loan?

A title loan is a type of lending where your means of transport is exploited as a collateral when you ask for a title loan. The estimation of your car plays the most important role, influencing the amount of the cash you will be able to receive. As soon as the applicant gets guaranteed approval title loan with no car inspection, the lender will give him money right away. The lender will keep your car’s title until the moment you repay the loan fully. You will be able to drive your car while repaying the loan.

Mind, that if a lender doesn’t manage to repay the loan on time, lender is allowed to take back the automobile to regain the losses. Before applying for this type of loan, make sure you can afford repaying the loan.

What do you need to provide for a car title loan?

You finally decided to apply for a title loan. “What do I need to provide?” you may ask yourself. Here is the answer! First of all a person applying for this kind of loan has to be of legal age or older. The proof of it should be a government-issued ID. A lien-free car title is obligatory if you are going to apply for a car title loan through a lender. You need to give ownership documents, vehicle information, and your license. And finally, the source of steady income id of great necessity.

If you wish to be approved for a car title loan, Meeting all of the expectations is obligatory. You can apply both offline and online. Right after the applying process is complete, you can expect immediate examination of your car. Finally, the loan assistant will offer you possible sum of money and fees.

What are the main advantages of a Car Title Loan?

Bigger Loan amounts

Since you are providing your car as a collateral, it is possible to receive larger loan amount than you would expect with unprotected car title loans. The amount of 25 to 50% of the vehicle’s value is what you can expect from a lender.

Fast application process

Nowadays it became possible to complete in a few moments in offline store or online with the help of your smartphone. For instance, fast online title loan in NC only ask you to provide personal and financial information, like the car’s title, verification of steady income and a government issued ID.

Instant funding

Right after the debtor makes an application, the process is very quick. First step is that your lender will make an examination of your car to find out how much it costs. Second, you get an offer with a sum of money and a percentage of the vehicle’s price. If you are satisfied and agree to the offer, you are only left to take the cash you need the same day or within 24 hours.

Bad credit is OK

Usually, title loans don’t have any strict requirements concerning your credit score. Therefore, debtors don’t need a good credit score to be qualified for one. Lenders will take into consideration aspects like income, employment history, and their car’s value, when deciding whether to approve you or not. The good news is that you can apply even if your credit score is far from perfect.

Gas Prices Growth

These days it happens that buying cars for the citizens of the USA becomes more and more complicated. Prices won’t stop growing. It is 12.6% price increase for brand-new vehicles and 16.1% for used cars, respectively.

Economical experts say that extending rates will beat consumers and the automobile sector in a number of fields, covering Title Loans as well.

When you analyze every hundred points increase in auto loan rates, it’s about $15 to $20 on a basis of about $600 on monthly installments.

Therefore, the increasing gas cost influences car title loan popularity (due to stats from official resource: PitriLoans.com). The average price of a gallon of gas now goes up to 5 $. Auto demand strongly suffers because of this this fact. And the problem is that prices are expected to continue growing. American citizens nowadays are paying enormous prices at the gas stations. Since gas is an input price into almost every product and business, everyone suffers from paying more for every service. Therefore, Americans go through hardships nowadays.

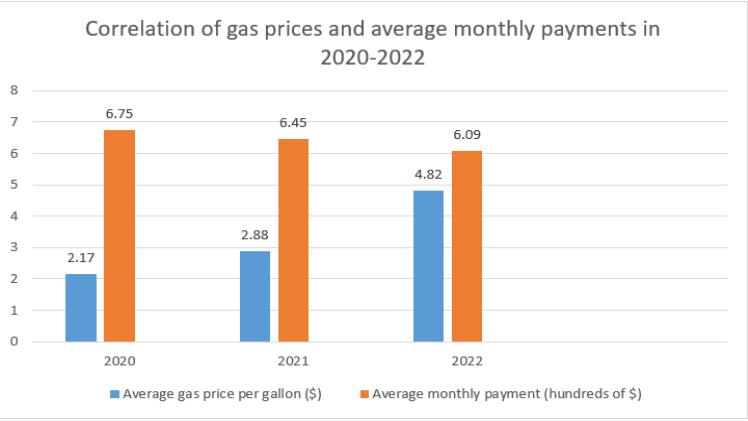

Here you can see the diagram showing correlation between growing gas prices and average monthly payments in 2020-2022.

The research shows that nowadays the growth of popularity of Loans by states, especially car Title Loans in Redding, California is expected and the growing Fuel Prices are one of the main reasons why you should consider a Car Title loan if you going through financial difficulties. Analyze thoroughly all the options Car Title market can offer you. That will help you to make the right choice and improve your credit history.